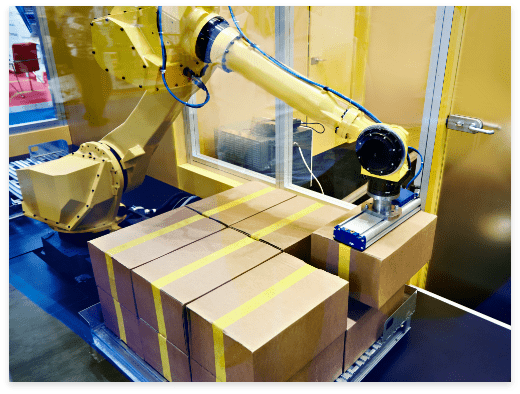

How we invest in the UK industrial market

All of the businesses within our Industrial portfolio present a strong balance sheet and have been profitable for a number of years. Handpicked for acquisition by our knowledgeable investment team, these businesses offer strong growth potential and long-term capital gain through further acquisition or investment in organic growth. Utilizing both our in-house experience and the knowledge of the business management teams, we aim to propel these businesses forward and capitalize on their potential.