2001

Cadman Capital Group is founded

With a lifelong interest in food and beverages, country pursuits, real estate in his native England and sustainable aquaculture, Chairman Giles Cadman’s passions underpinned the birth of the Cadman Capital Group.

The Cadman Capital Group has evolved considerably since its inception in 2001, with both our team and our portfolio companies experiencing significant growth. Passion remains the driving force behind our business, underpinned by high-level investment knowledge, proficient business acumen and continuous close monitoring of our markets.

With a lifelong interest in food and beverages, country pursuits, real estate in his native England and sustainable aquaculture, Chairman Giles Cadman’s passions underpinned the birth of the Cadman Capital Group.

2004 marks the creation of Cadman Fine Wines, which saw the Cadman Capital Group enter the direct-to-consumer fine wine market for the very first time.

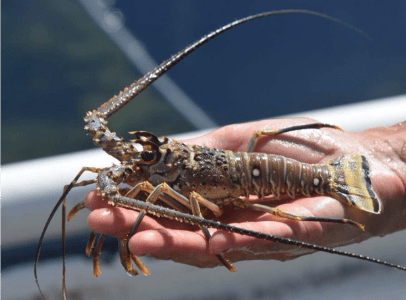

Following initial discussions in late 2004, the Cadman Capital Group officially entered the aquaculture market in 2005 with the creation of Caribbean Sustainable Fisheries, a land-based spiny lobster farm located in the British Virgin Islands.

The Group entered the Real Estate market in December 2010, when it founded Boone Real Estate.

The Cadman Capital Group grew both organically and through acquisition in 2011, when it acquired Golden West Wines to expand its direct-to-consumer wine operations and gain market share in the American retail wine market. It also increased its share of the UK property market with the creation of Enterprise Real Estate.

In May 2012, the acquisition of Classic Countrywear Limited, which trades as Tredders, saw the Group take its first step into the lifestyle space. Tredders, which was once a footwear business operating solely at trade shows, has now grown to become a successful e-commerce business and store, stocking the world’s very best handmade footwear from top brands.

2014 saw the Group’s Real Estate portfolio expand with the addition of Ardent Property Investments – a start-up company focused on selecting and developing properties in search of return.

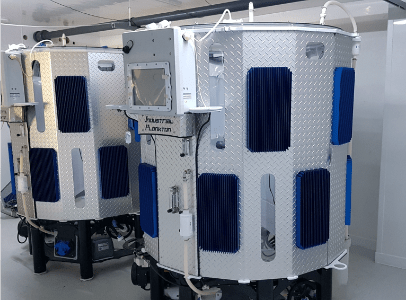

2017 saw the Group’s interest in aquaculture triple in size as it began the build of Orkney Shellfish Hatchery – a multi-species aquaculture hatchery located in Scotland. In addition, the Group also acquired Shellfish Hatchery Systems – a ground-breaking aquaculture technology business, which was rebranded to Ocean On Land Technology in January 2020.

In 2018, the Group founded Cadman Sporting – a one stop shop for everything country sports. The creation of Cadman Sporting formed part of a wider acquisitions strategy that was executed the following year.

2019 was a busy year, which saw the Group acquire an additional four businesses, including the acquisition of a further retail wine business, The New Zealand House of Wine. In addition, the Group also founded The South Africa House of Wine, which replicates the successful business model of The New Zealand House of Wine. Further acquisitions within the country sports market included the purchase of two gun shops – Northampton Gun and Rugby Gun, as well as clay pigeon shooting ground, Barby Sporting.

Despite the extraordinary circumstances of 2020, the Group experienced another busy year – completing the acquisition of a further four business. Two of the acquired businesses were Lake Street Vineyard (now operating as Highweald Wine) and 360 Degree Brewing Company. In addition, the Group entered a new market with the purchase of two packaging businesses - Norpol Packaging and Burbridge Packaging.

A strong start to 2021 has seen the Group acquire a further four businesses within the first seven months of the year. An established North Wales brewer, Conwy Brewery was the first to join the portfolio, further increasing our market share in the craft beer and UK beverages markets. The second acquisition of Pookchurch Vineyard - a 100-acre vineyard situated on the Sussex High Weald further strengthens the Highweald Wine portfolio and positions the business in the top 10% of land-under-vine owners. Whittlesey Gun Shop was the Group's third acquisition, expanding the geographical reach of our businesses within the country sports market, with a primary focus on the sports shooting sector, whilst the acquisition of specialist packaging manufacturer, Cheshire Polythene adds further value to our Industrial portfolio.